Even amid political strains and economic unpredictability, the US stock market has continued to outperform projections, with the Dow Jones Industrial Average nearing unprecedented peaks.

Investors are navigating a complex landscape: international crises, domestic unrest, and mixed economic signals have created a climate where traditional market reactions seem upended. Yet, the Dow, which tracks 30 of America’s largest publicly traded companies, remains on a trajectory toward historic levels, leaving analysts and observers asking why the market appears resilient in the face of apparent instability.

Political headlines versus economic realities

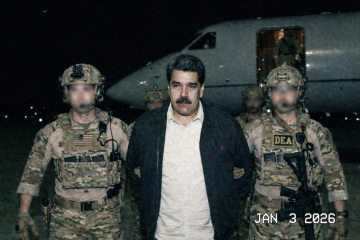

Recent developments have sketched a volatile scene. On the international front, Venezuela is dealing with strikes and political turmoil, while the United States has grappled with prominent disputes, including assertions about extending territory toward Greenland. At home, demonstrations have surged in reaction to disputed law enforcement actions, and the economy ended 2025 with modest job growth. Traditionally, these factors might suggest a looming market slide, yet the Dow presents another narrative.

Wall Street’s focus is largely on the economic implications of political events rather than the headlines themselves. For instance, speculation about strikes in Venezuela often centers on potential disruptions to global oil supplies. However, the U.S. has proposed significant investments in Venezuela’s oil infrastructure, potentially unlocking access to crude reserves that account for roughly a fifth of the world’s total, according to the U.S. Energy Information Administration.

Investors recognize that while geopolitical developments can increase uncertainty, they do not automatically translate into market losses unless the situations escalate to extreme levels. As Jay Hatfield, CEO of Infrastructure Capital Advisors, explained, the stock market reacts primarily to economic drivers rather than political drama. U.S. officials have reported strong interest from major oil companies in exploring opportunities in Venezuela, suggesting that expanded energy production could stimulate economic growth—an encouraging signal for the market.

Consumer behavior continues to show remarkable resilience

Domestically, consumer confidence has shown unexpected resilience. The University of Michigan’s consumer sentiment survey indicated a rise in January, marking a second consecutive month of improvement. Even with rising costs for groceries and services, Americans continue to spend, supporting retail sales and economic activity.

The trend illustrates a distinctly K-shaped economic rebound, as higher-income households, supported by stock market gains, rising wages, and appreciating home values, continue driving spending, while lower-income families, constrained by weak job creation, elevated debt, and persistent inflation, remain wary. Yet retail performance stays resilient, with Mastercard SpendingPulse reporting a 4.1% year-over-year increase in Black Friday sales, underscoring steady consumer participation.

According to Paul Christopher of Wells Fargo Investment Institute, Americans appear wary yet far from alarmed. “They’re somewhat concerned that new positions aren’t emerging, though they’re also not seeing widespread job losses,” he remarked. This blend of measured optimism and anticipation of more robust hiring in 2026 helps foster conditions that are favorable for equity markets.

Rising market confidence driven by evolving interest rate expectations

Another significant element influencing the Dow’s trajectory is how investors perceive Federal Reserve policy. After three consecutive rate cuts in 2025, many remain hopeful that further easing may reinforce economic momentum. Reduced interest rates frequently make borrowing more accessible, encourage corporate investment, and sustain market liquidity, conditions that can collectively push stock valuations higher.

As earnings season nears and releases like the Bureau of Labor Statistics’ Consumer Price Index come out, analysts indicate that the market will largely move past political noise. Christopher noted that actions taken by the Fed, especially as steady job growth continues, help reassure investors and strengthen confidence in the broader economy.

Market volatility may linger, yet the broader outlook reflects notable resilience, as economic fundamentals—from consumer spending trends and energy investment potential to supportive monetary policy—continue to underpin steady gains in equities despite geopolitical uncertainty and fluctuating domestic sentiment.

The Dow’s march toward 50,000 points reflects a nuanced reality: investors weigh economic data more heavily than media coverage of political crises. While headlines capture attention, financial markets respond primarily to tangible economic outcomes and future expectations. As a result, the seeming contradiction of a strong market amid turmoil is less surprising when viewed through the lens of economic fundamentals and investor behavior.

Ultimately, the U.S. stock market underscores a wider truth about how perception often diverges from reality, as political narratives and worldwide developments may fill headlines while markets respond instead to concrete economic indicators that shape corporate earnings and consumer behavior; this contrast clarifies why record-breaking performance can still emerge in a year defined by uncertainty and debate.

This article is regularly refreshed and originates from the CNN website.